Blogs

If you value understanding my 150-term stories, please also consider studying certainly my courses, and informing anybody else about the subject, also. Like Zoya’s depiction out of exactly how particular dating and other people are just designed to teach us a lesson. Konkana discovered the necessity of simply going after what you want and you can looking to their chance (She acquired the new refrigerator contest). Farhan learned the necessity of with you to confidant and you can service inside the your life. Believe shedding the new love of your lifetime as well as locating the same face once more, and he As well as goes wrong with love your?

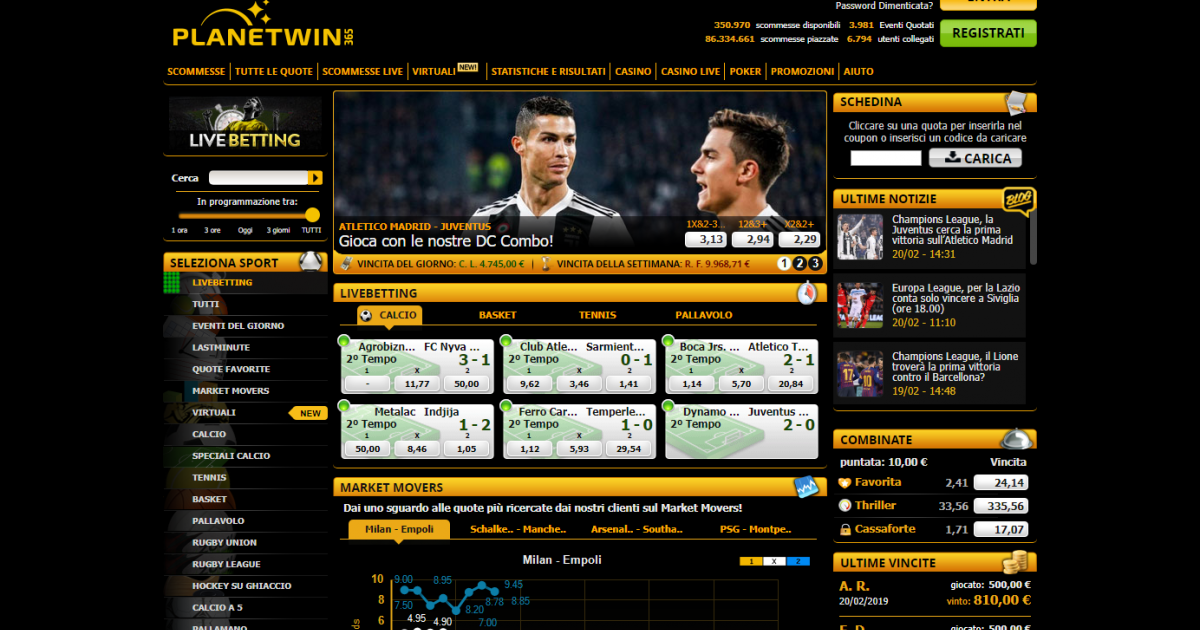

Popular inside Life | casino Planet 7 Oz login

It’s nothing like if a female compromises, she’ll obviously rating a job,” he said as outlined by Asia Now. Zoya Akhtar’s directorial finesse in the ‘Fortune By chance’ gets obvious within the ability to bring the brand new essence of one’s flick industry’s rawness, making it related and you may relatable across the years. The fresh letters, expertly portrayed because of the Farhan Akhtar and you can Konkana Sen Sharma, linger regarding the audience’s recollections, exhibiting Zoya’s talent to possess crafting compelling and you can unforgettable internautas. The fresh film’s mining away from goals, aspirations, and also the the inner workings of the enjoyment globe features turned they to your an excellent movie pilgrimage for these trying to narratives one transcend the normal. From the arena of Bollywood classics, Zoya Akhtar’s directorial debut, “Fortune By chance,” really stands as the a traditional jewel one continues to amuse visitors even today. The movie, famous for the unique story and you will flawless storytelling, features gained extensive important recognition, cementing their invest the brand new minds from cinephiles.

- Pillai reported that the film would be completely sample to your Mumbai Pune Expressway and you may Hyderabad.9 Inside later August, the first agenda ended up being finished at the Hyderabad.

- She contacted 6 actors to try out the lead part and you will encountered rejection from their store all.

- Dev phones corporator Aslam Bhai, whom volunteers to clear the fresh tracks to the car to pass as a result of.

Anushka Sharma

Nothing to lose heart Sam begins living in his rickety dated auto and starts exercises dancing in the a college to young babies that have never ever obtained any dancing battle. ‘Chance Pe Dance’ is the tale of an experienced and you will passionate young troubled actor titled Sameer. Confident and you can brimming with energy, Sameer juggles some work if you are functioning on the bringing his large split in the market. Satisfy 20-one thing Myra Karn (whom doesn’t wish to fool around with the girl last label), an engineering scholar which didn’t feel the smallest clue one she’d property a member within the really anticipated video of the season.

Release

Rehan is casino Planet 7 Oz login hurried on the healthcare that is declared brain lifeless, becoming remaining live to your a great ventilator. At the same time inside the Pune, Dev Kapoor’s girl Ria’s center reputation gets worse, and she is inside the immediate need of a middle. Rehan’s cardiovascular system is still doing work which can be open to Ria to own transplantation. Yet not, Rehan’s mothers deny, but during the insistence from Rajeev and you can Rehan’s girlfriend, Aditi, whom inform them that it’s as well rescue an existence. Fortune by chance was initially planned to appear 23 January 2009, alongside Raaz – The newest Secret Continues on, however, is forced in order to 31 January. Chance by chance premiered to the 900 microsoft windows around the world within the 27 nations.

Shah Rukh advises Vikram not to forget about people that endured by the him before he had been popular. Delivering adhere for the, Vikram check outs Sona and you may apologizes for their fling having Nikki. The guy conveys shame, however, Sona believes she’s seen an adequate amount of your to learn his genuine nature and treks out of his existence. If you are operating aside, Sona reflects on her behalf lifetime, feeling pleased with best a comfortable, separate existence even with never ever making it since the a major flick star. And now, i have got a private information with this Dish-India celebrity.

Trending reports

The marriage card of this breathtaking couple try intricately designed and looked very classy. The newest gold-plated invitation had stunning flower printing and you can are displayed inside the an excellent package. It package consisted of numerous literature providing information on Arpita Khan’s wedding day and all of almost every other pre-marriage functions. That it flick is breathtaking and their like story had every certainly one of united states whining.

Kabir Singh

But an extended focus on and better life contour totally hinges on if the motion picture is citation the fresh Friday sample by steering clear of an excellent large shed. Imtiaz produced their first while the a director to the 2005 film Socha Na Tha. He then directed video such as Like Aaj Kal, Road, Jab I Came across, Jab Harry Came across Sejal, Laila Majnu and Love Aaj Kal. Their past movie try Amar Singh Chamkila starring Diljit Dosanjh and Parineeti Chopra.